Cashing in on property

Intense media coverage of the opportunities to be had in residential property post A-Day, creating fears of potential mis-selling. Residential property seems to be the single most exciting opportunity encompassed in the forthcoming A-day changes, if you believe the press coverage.

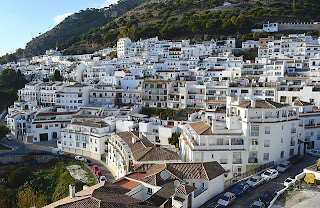

Much has been written over recent months about the many opportunities for those with buy-to-let properties or holiday homes to shelter these investments in their retirement plans.

The only problem with this type of coverage is that it is making residential property in Sipps seem like an easy prospect and the bears in this market already fear the potential mis-selling that could arise.

The bulls for residential property in Sipps believe it offers interesting opportunities, shelters some property from CGT and that it will attract a lot more interest to pension planning full stop.

The bears proclaim that only a tiny minority of people will ever be able to take advantage of such flexible investment rules and believe investors should be wary of such schemes.

Much has been written over recent months about the many opportunities for those with buy-to-let properties or holiday homes to shelter these investments in their retirement plans.

The only problem with this type of coverage is that it is making residential property in Sipps seem like an easy prospect and the bears in this market already fear the potential mis-selling that could arise.

The bulls for residential property in Sipps believe it offers interesting opportunities, shelters some property from CGT and that it will attract a lot more interest to pension planning full stop.

The bears proclaim that only a tiny minority of people will ever be able to take advantage of such flexible investment rules and believe investors should be wary of such schemes.