Property As A Pension!

Currently, investors in Self-Invested Personal Pensions (SIPPs) can invest in land, property funds, property-company shares or a single commercial property.

However from 6 April next year, investors will be allowed to buy domestic property within a SIPP. A whole heap of SIPP providers and property firms are excitedly talking up this opportunity, but there are risks involved in going down this route. Indeed, leading insurer Norwich Union yesterday warned that investors could use their pension fund to buy into property without considering the downside.

After pensions A-Day, SIPP holders have several options, such as using their pension fund to buy their family home, a second home, buy-to-let property or even a holiday home abroad. More than half a million Brits own second homes, roughly two-thirds of which are in the UK, and many of these wealthy investors are expected to transfer their property into SIPPs.

There are huge tax advantages in going down the property-SIPP route, because investors get tax relief on their contributions to a SIPP, which could effectively reduce the property cost by up to two fifths (40%). What's more, the fund doesn't pay tax on its rental income and capital gains from rising property prices.

However, the price you pay for this generous tax treatment is that you lose control of the property, which now belongs to your SIPP's trustee, which is usually a bank or insurer.

In addition, your SIPP has to pay stamp duty on purchases, at up to 4% of the property's value. A further complication is that SIPPs charge far higher annual management fees when compared to personal and Stakeholder pensions.

In effect, by putting your family home into a SIPP, you become a tenant, with your SIPP manager as your landlord. As you've forfeited ownership of your property, you need permission from your pension trustee before making alterations to your home. With buy-to-let property SIPPS, the trustee is responsible for maintaining the property, so it will contract out this work to a management company and charge you for this service.

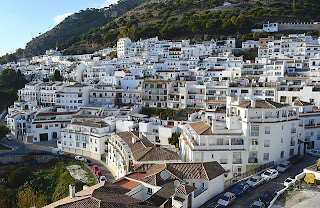

Furthermore, although the tax treatment of property SIPPs is very generous, investors with properties abroad may fall foul of overseas tax laws, because many countries (including Portugal and Spain) do not recognise trusts. This could leave investors liable to pay substantial levies on their capital gains and assets, plus expensive legal bills.

Cliff D'Arcy reports.

However from 6 April next year, investors will be allowed to buy domestic property within a SIPP. A whole heap of SIPP providers and property firms are excitedly talking up this opportunity, but there are risks involved in going down this route. Indeed, leading insurer Norwich Union yesterday warned that investors could use their pension fund to buy into property without considering the downside.

After pensions A-Day, SIPP holders have several options, such as using their pension fund to buy their family home, a second home, buy-to-let property or even a holiday home abroad. More than half a million Brits own second homes, roughly two-thirds of which are in the UK, and many of these wealthy investors are expected to transfer their property into SIPPs.

There are huge tax advantages in going down the property-SIPP route, because investors get tax relief on their contributions to a SIPP, which could effectively reduce the property cost by up to two fifths (40%). What's more, the fund doesn't pay tax on its rental income and capital gains from rising property prices.

However, the price you pay for this generous tax treatment is that you lose control of the property, which now belongs to your SIPP's trustee, which is usually a bank or insurer.

In addition, your SIPP has to pay stamp duty on purchases, at up to 4% of the property's value. A further complication is that SIPPs charge far higher annual management fees when compared to personal and Stakeholder pensions.

In effect, by putting your family home into a SIPP, you become a tenant, with your SIPP manager as your landlord. As you've forfeited ownership of your property, you need permission from your pension trustee before making alterations to your home. With buy-to-let property SIPPS, the trustee is responsible for maintaining the property, so it will contract out this work to a management company and charge you for this service.

Furthermore, although the tax treatment of property SIPPs is very generous, investors with properties abroad may fall foul of overseas tax laws, because many countries (including Portugal and Spain) do not recognise trusts. This could leave investors liable to pay substantial levies on their capital gains and assets, plus expensive legal bills.

Cliff D'Arcy reports.

Comments

Post a Comment